- Written by

- Sophie Boxall, Senior Associate Solicitor

If you die without a Will (or a validly executed Will) certain rules, known as the Intestacy Rules, determine who is entitled to inherit your estate irrespective of your wishes.

If you are married or in a civil partnership at the time of your death and you do not have any surviving children (grandchildren or great-grandchildren) then your surviving spouse or civil partner will receive your entire estate.

If you are married or in a civil partnership and have children (grandchildren or great-grandchildren) then your spouse or civil partner will receive:

- All of your personal possessions

- The first £322,000 of your estate

- Half of the remaining estate

Your children will receive the other half of the remaining estate equally between them. If your child has died before you, their share shall pass to their children equally.

If you are not married or in a civil partnership but you have children then your children will receive your estate in equal shares (again if any of them die before you leaving children, their children will receive their share equally).

If you are not married or in a civil partnership and do not have children (or grandchildren) at the time of your death then it can become more complicated as your estate will pass to your next closest relative which may not be your intention. In particular, if you are co-habiting and not legally married or civil partners then your partner will have no legal right to your estate so it is essential you put a valid Will in place if you would like your partner to inherit from your estate.

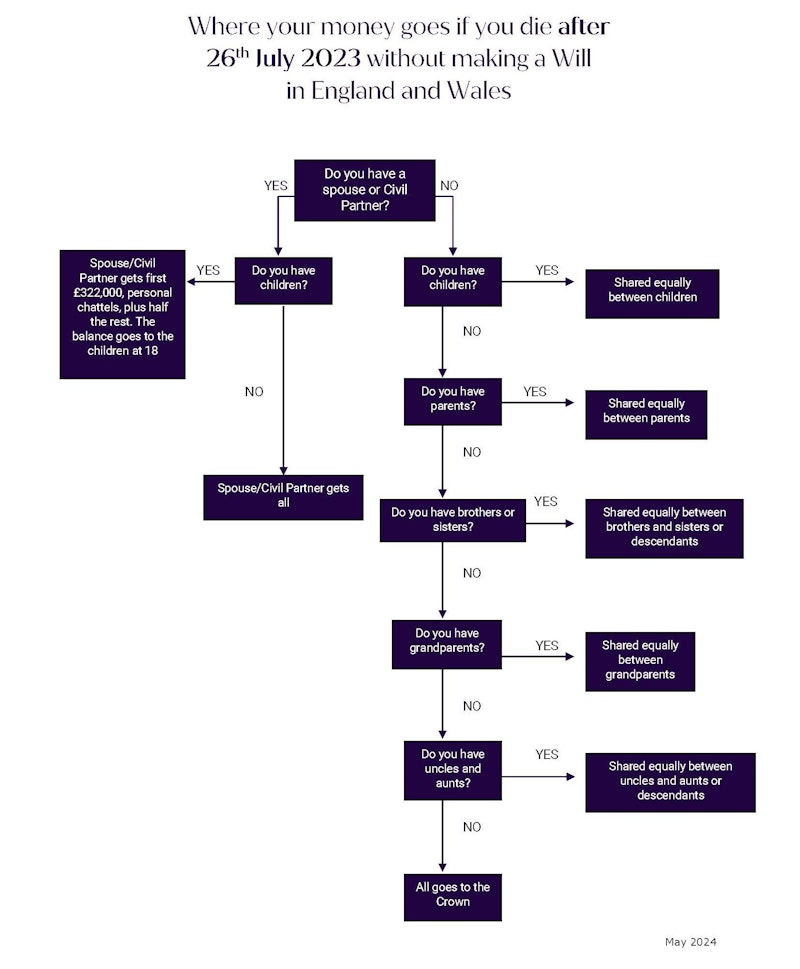

This flowchart demonstrates the order of entitlement to your estate:

Please note assets held as joint tenants will pass automatically to the surviving joint owner irrespective of the intestacy rules mentioned above.

If you have no living relatives your entire estate passes to the Crown so it is essential you have a valid Will in place to reflect your wishes.

Not only is it essential to put a Will in place to ensure your estate passes to your intended beneficiaries, but it also makes the process of administering an estate much simpler when a person dies. If someone dies without a Will and does not have any immediately close relatives, it can often present a difficult task for the legal representative to establish who the legal heirs are. They may have to trace the family tree to ascertain beneficiaries, which can be time consuming and costly for the estate.

If your loved one has died without leaving a Will, or if you need to put a Will in place, our expert team can help. We specialise in administering intestate estates and can guide you through the Intestacy Rules, help apply for Letters of Administration and ensure the estate is distributed correctly.

Please call us on 0208 290 0440.

Related News & Insights

-

The greatest gift? Peace of mind this Christmas

Articles | 13 November 2025

-

Are you part of the 41% Club?

Articles | 29 October 2025

-

Pensions, Inheritance Tax, and changes from 6th April 2027

News | 11 April 2025

-

Our WIQS Accreditation - What does it mean?

News | 8 January 2025